Our Mission

Our mission is to empower microfinance institutions in Bangladesh with innovative, reliable, and user-friendly software solutions that streamline operations, enhance transparency, and enable data-driven decision-making. We strive to support MFIs in serving their members efficiently, promoting financial inclusion, and fostering sustainable growth in communities across the country.

Our Vision

Our vision is to be the leading digital partner for microfinance institutions in Bangladesh, transforming the way they operate by providing innovative, accessible, and efficient software solutions. We aim to empower MFIs to reach every community, ensure financial inclusion, and create lasting positive impact in the lives of millions.

Our Parent Company

Commencement Year:

Commenced Operation in 2013

Area of Business:

Software Development in various fields, including micro-finance institutions.

Potential Customers

Mostly all the microfinance institutes (ক্ষুদ্রঋন দানকারি প্রতিষ্ঠান) & Cooperative Societies (সমবায় সমিতি)

Our Foundation

We started our journey in the year 2010 to introduce Mobile based automatic emergency credit card, Swosti for the poor and underprivileged of the society. We partnered with DSK (Dushtha Shasthya Kendra) for lending and DBBL for mobile banking platform, Rocket. After initial piloting of the application, the program was launched on September 4, 2013 by Dr. Atiur Rahman, the then BB Governor. PKSF Chairman Dr. Qazi Kholiquzzaman Ahmad was the Chief Guest to the program. This concept of mobile based emergency credit application received m-Billionth Award-2014 from New Delhi, India.

Partnership with DSK(Dustha Shasthya Kendra) & DBBL (Dutch Bangla Bank Limited)

Swosti partnered with DSK (Dushtha Shasthya Kendra), a national NGO and Micro Finance Institution (MFI) to rollout the MCC among its beneficiary members using DBBL Mobile Banking Platform, Rocket.

Swosti – MCC was launched on September 4, 2013 by Dr. Atiur Rahman, Bangladesh Bank Governor where Dr. Qazi Kholiquzzaman Ahmad, PKSF Chairman was the special guest. The concept of Swosti-Emergency Loan brought much vibration and appreciation in the local market and local media published the launching news with due prominence.

Swosti – MCC received prestigious mBillionth Award – 2014 for its innovative approach to a conventional stumbling block of getting credit by the underprivileged people of the society.

Our Team

Our team consists of experienced software engineers, creative designers, and strategic thinkers who are passionate about technology and innovation. along with it the team consists of young, energetic, experienced Relationship managers who provide 24/7 customer services.We work collaboratively to deliver solutions that are tailored to the specific needs of each client.

Our Products

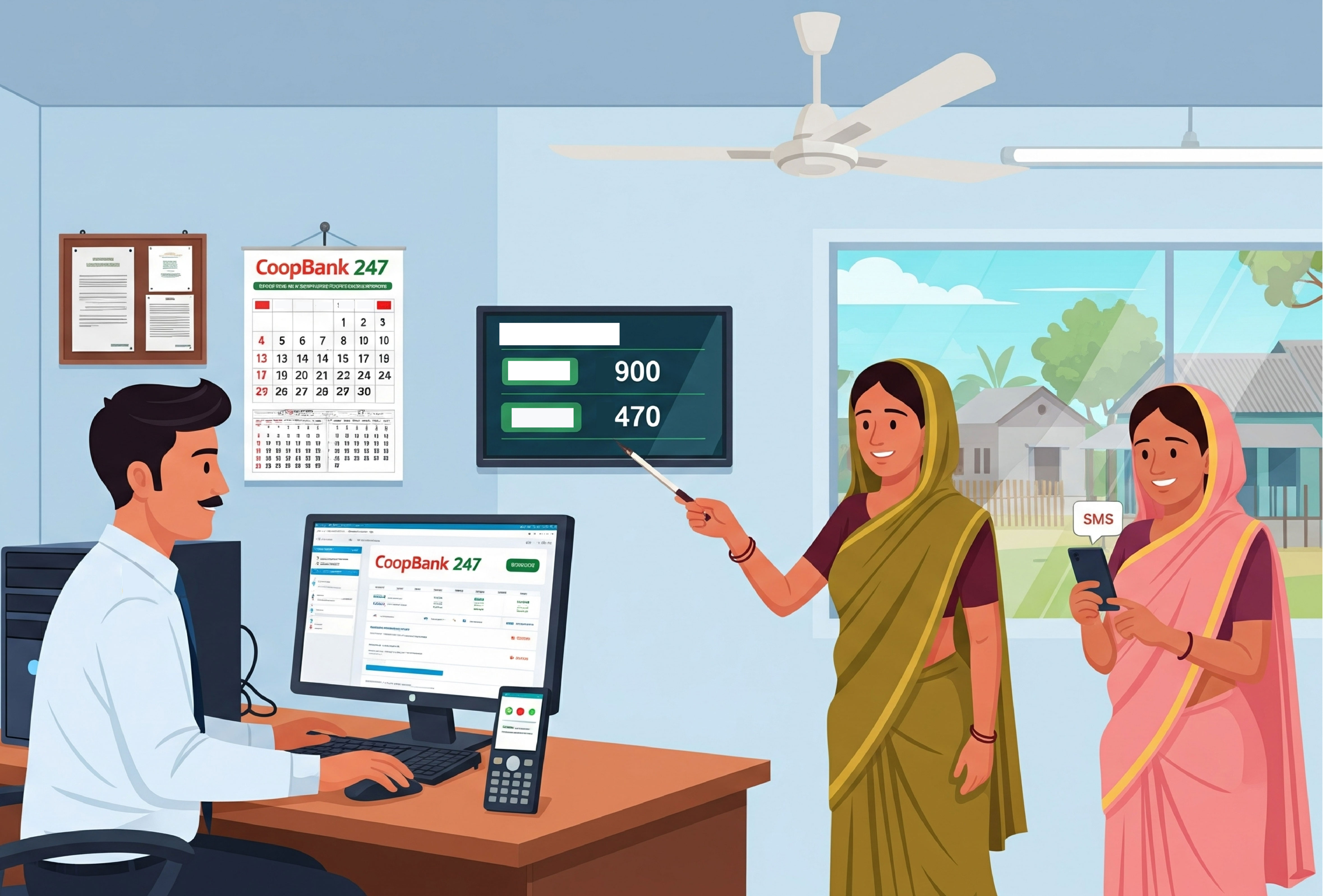

Swosti CoopBank247

Swosti CoopBank247 is a comprehensive banking software designed for cooperative banks and credit unions. It helps automate banking processes while maintaining regulatory compliance.

Key Features:

✅ Savings & Deposits Management – Tracks member deposits and transactions.

✅ Loan & Credit Management – Automates loan processing and repayments.

✅ Core Banking System (CBS) – Supports multiple branches and real-time banking.

✅ Accounting & Compliance – Ensures financial transparency and regulatory adherence.

✅ Member & Shareholder Management – Tracks cooperative members and profit-sharing.

Swosti MFI247

Swosti MFI247 is a cloud-based, paperless microcredit management software that helps MFIs efficiently manage their lending operations.

Key Features:

✅ Loan Management – Automates loan applications, disbursements, and repayments.

✅ Online & Offline Access – Works with or without an internet connection.

✅ Paperless Transactions – Reduces paperwork for better efficiency.

✅ Client & Group Management – Stores borrower profiles and group loan structures.

✅ Accounting & Reporting – Provides detailed financial reports.

✅ Mobile & Web Access – Field officers can update data from mobile devices.