ইন্টারনেট ছাড়াই !

কিস্তির হিসাব হোক এখন মোবাইলে

Years of Experience

About Us

We offer advanced software solutions for MFIs (Micro Finance Institutions) and Cooperatives, enhancing operational efficiency, Member management, and financial services. We provide a complete Paperless Microcredit system. Swosti Software is an excellent tool for Top Management (such as Executive Director, Managing Director, CEOs and senior Management staffs). Field officer can easily enter loan and savings data in the app without carrying any paper based collection sheet. We have user-friendly platform which supports both online and offline operations at the comfort of Mobile, Laptop or Desktop.

Our Services

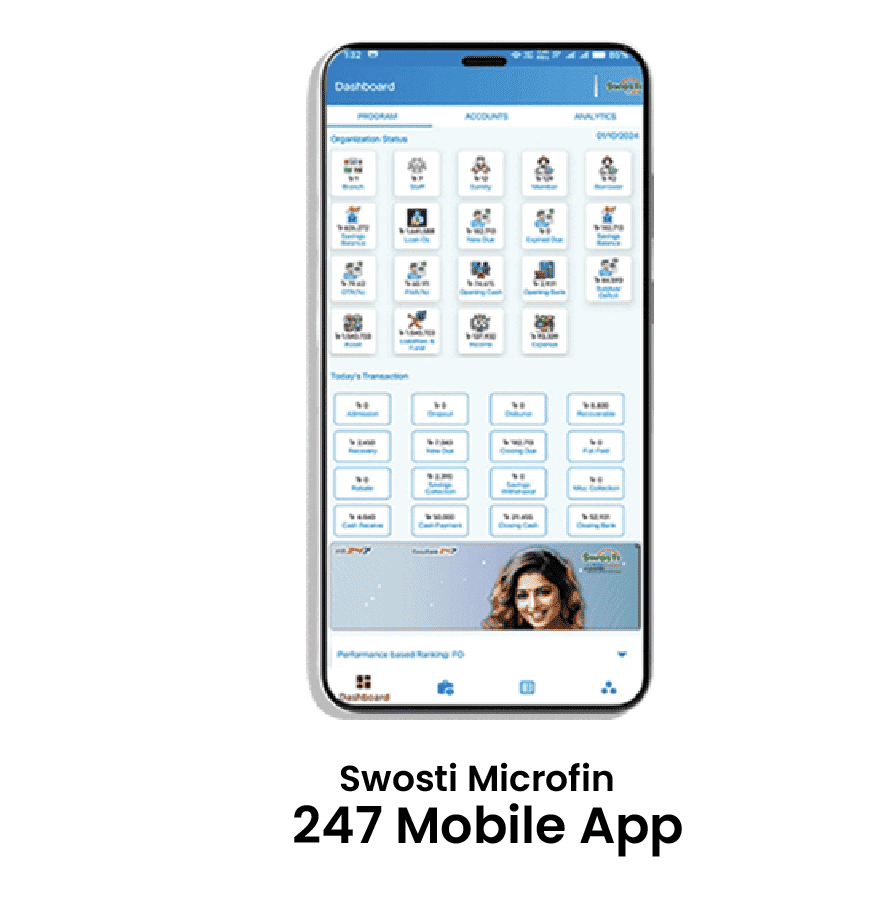

mfi247

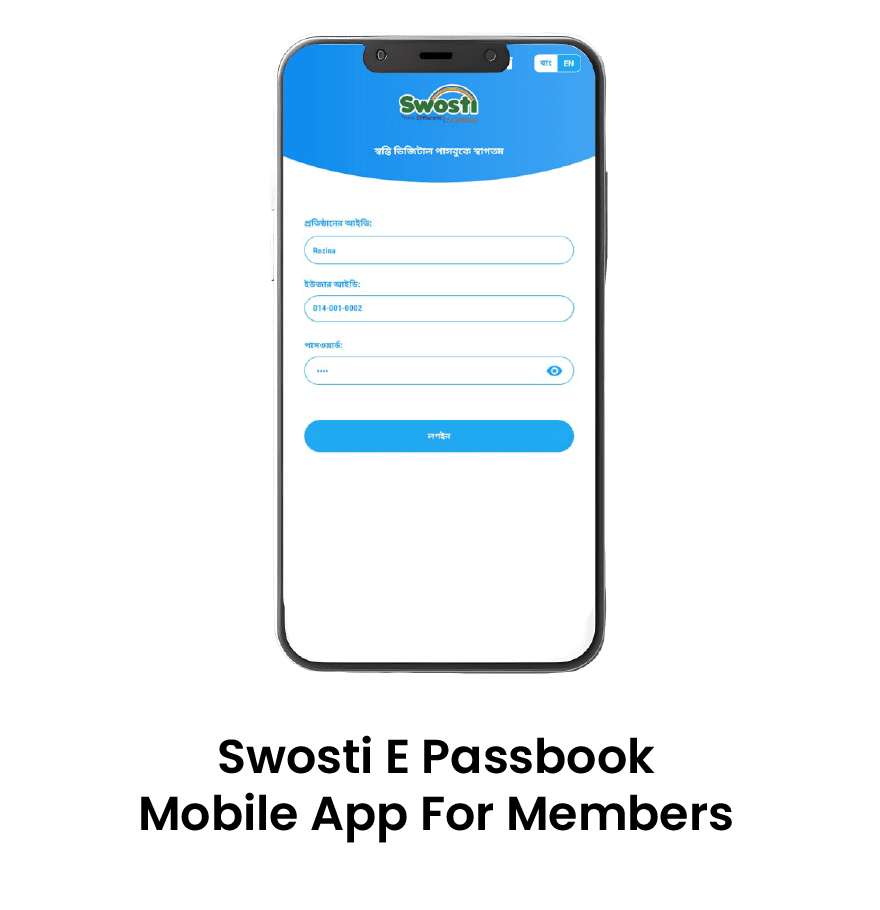

Swosti MFI247 software service offers comprehensive digital solution for microfinance operation in Bangladesh. It runs both offline and online without needing any paper-based Collection Sheet. Members can get transaction alert from digital Passbook instantly.

CoopBank247

Swosti CoopBank247 is a paperless Micro-credit software solution for the Credit Cooperatives in Bangladesh. It operates both offline and online. Members can instantly get alert on any transaction through their digital Passbook (Mobile app based).

Why choose Swosti?

Swosti is the best Microfinance & Somity Software that is tailored to the microfinance sector, helping you manage your operations more effectively and efficiently. Swosti provides offline-based Loan and Savings collection entries while there is no internet or electricity at the work-place. It is a special package of microfinance solution with its comprehensive features, User-Friendly Interface, Customization Option, Regulatory Compliance, Scalability, Integration capabilities, Robust security, support and training and last of all cost effective.

Our Clients

MFI Clients

Cooperative Clients

Testimonial